Definition: Cost of Goods Sold (COGS) is the sum of the Direct costs and Manufacturing Overhead attributable to the production of goods sold by a company. It includes:

- Cost of direct labour (wages for workers working directly on the product being manufactured)

- Cost of direct materials (materials, components used in the manufacturing of the product)

- Manufacturing Overhead attributable to the product's manufacturing process.

We are going to dig deep into COGS, but feel free to jump to any section you want to:

What is included in Cost of Goods Sold?

Very simply, Cost of Goods Sold = Direct Costs + Manufacturing Overhead.

In this section, we describe in detail what these components mean, and what they include.

Source: The Economics Journey

1. Direct costs

Direct costs of production are those costs that can be easily attributed to specific Cost objects i.e. specific final products and services.

These include:

- The cost of direct labour i.e. wages of factory workers working directly on manufacturing the product on the shop floor.

- The cost of direct materials i.e. materials and components used directly in the manufacturing of the product.

These costs can be attributed to the manufacturing of the product with a high level of accuracy and little effort. They form part of the COGS for the product.

- Example

Let us assume that factory 'A' manufactures washing machines and microwave ovens. We want to determine the Cost of Goods Sold for washing machines produced in this factory.

The wages paid to factory workers involved directly in the manufacture of washing machines (i.e. in the fabrication, sub-assembly and assembly of washing machines) and materials used specifically in the manufacture of washing machines (such as steel sheets, plastic, aluminium, rubber hoses, prefabricated motors and electronic controls) are Direct costs.

These costs can be attributed accurately and with ease to the manufacture of washing machines, and form part of the COGS for washing machines.

The wages paid to factory workers involved directly in the manufacture of washing machines (i.e. in the fabrication, sub-assembly and assembly of washing machines) and materials used specifically in the manufacture of washing machines (such as steel sheets, plastic, aluminium, rubber hoses, prefabricated motors and electronic controls) are Direct costs.

These costs can be attributed accurately and with ease to the manufacture of washing machines, and form part of the COGS for washing machines.

2. Manufacturing Overhead

Overhead (or Indirect cost) on the other hand, is comprised of costs that cannot be accurately attributed to specific Cost objects with ease.

Overhead is of two types: i) Manufacturing Overhead, and ii) Corporate Overhead.

Only Manufacturing Overhead is included in COGS.

Source: The Economics Journey

Overhead is of two types: i) Manufacturing Overhead, and ii) Corporate Overhead.

Only Manufacturing Overhead is included in COGS.

Source: The Economics Journey

- Components of Manufacturing Overhead

Manufacturing Overhead (or Factory Overhead) includes manufacturing costs (or factory costs) that cannot be easily attributed to specific Cost objects.

Since direct labour and direct materials are the only costs in a factory that are considered Direct Costs (i.e. easily attributable), all the other costs of running the factory are usually included in Manufacturing Overhead.

Manufacturing Overhead includes:

Since direct labour and direct materials are the only costs in a factory that are considered Direct Costs (i.e. easily attributable), all the other costs of running the factory are usually included in Manufacturing Overhead.

Manufacturing Overhead includes:

- Rent paid for the factory

- Electricity, water and other utility bills for the factory

- Factory insurance

- Factory depreciation charge

- Property tax for the factory

- Factory supplies not related to manufacturing (e.g. stationary, sanitation supplies)

- Salaries of the factory manager, quality control, maintenance, security, administrative, janitorial and other non-manufacturing staff.

- How is Manufacturing Overhead calculated?

If only one product is produced at a factory, it is easy to calculate Manufacturing Overhead for this product. All one has to do is identity all the expenses (listed above) included in Manufacturing Overhead, and sum them up.

However, if multiple products are produced at a factory, then the entire Manufacturing Overhead is not attributable to any single product. This is when judgement has to be exercised.

However, if multiple products are produced at a factory, then the entire Manufacturing Overhead is not attributable to any single product. This is when judgement has to be exercised.

There are two ways of allocating Manufacturing Overhead:

- In proportion to the number of labour hours needed to produce one unit. (This method is used when the manufacturing process is labour intensive)

- In proportion to the number of machine hours needed to produce one unit. (This method is used when the manufacturing process is mostly automated and the need for direct labour is low)

- Example of Manufacturing Overhead Allocation

Let us use the same example of factory 'A' that manufactures washing machines and microwave ovens. We have to estimate Manufacturing Overhead attributable to washing machines.

The manufacturing process for both washing machines and microwave ovens is highly automated. So it makes sense assign to Manufacturing Overhead in proportion to the number of machine hours used per unit.

Data Available:

Allocation in proportion to machine hours used:

Total no. of machine hours used for manufacturing washing machines = 100 x 20 = 2,000

Total no. of machine hours used for manufacturing microwave ovens = 50 x 25 = 1,250

Machine hours used for washing machines as % of total machine hours used = 2,000/ (2,000 +1,250) = 62%

Hence,

Manufacturing Overhead attributable to washing machines:

= 62% x Rs 50,000 = Rs 31,000

Manufacturing Overhead per washing machine unit:

= Rs 50,000/ 100 = Rs 500

= Rs 50,000/ 100 = Rs 500

A short Note on Corporate Overhead (not included in COGS)

We know that besides Manufacturing Overhead, that comprises of all the indirect costs incurred in the factory, there is another type of Overhead called 'Corporate Overhead'.

Corporate Overhead comprises of all the indirect business expenses (not part of actual production expense) incurred outside of the factory, that are required to run the firm.

These include:

As stated before, Corporate Overhead is not part of COGS.

Corporate Overhead comprises of all the indirect business expenses (not part of actual production expense) incurred outside of the factory, that are required to run the firm.

These include:

- Sales force costs

- office administrative costs

- head-office and regional office manager salaries

- administrative staff salaries

- utilities cost for the regional and head offices

- interest charges for the firm

- marketing costs

- legal fees

- insurance charges for the firm

Why is Cost of Goods Sold Important?

Cost of Goods Sold is important because subtracting COGS from the Sales of a company, gives us its Gross Profit. Gross Margin (GM) which is = Gross Profit/ Sales, is a very important profitability metric for a business. It is used by owners, investors and others stakeholders to company evaluate performance. Company management teams will often set Gross Margin targets for future years in order to improve cost control, increase profit metrics and please investors who see rising GMs as a sign of future profitability and cash flows.

Gross Margin (%) = Gross Profit / Sales = (Sales - COGS) /Sales

Formula for Cost of Goods Sold

The incomplete identity that most texts provide is: Beginning inventory + Purchases = COGS + Ending Inventory.

This is only part of the picture and an over-simplification, as I’m sure you’ll agree if you’ve read thus far. The calculation of Cost of Goods Sold for a business needs to account for direct labour costs and overhead related to manufacturing as well.

The complete identity to calculate Cost of Goods Sold is: Beginning Inventory + Purchases + Direct labour costs + Overhead (manufacturing) = COGS + Ending Inventory or

Cost of Goods Sold = Purchases + Direct labour costs + Overhead (manufacturing) - (Ending Inventory - Beginning Inventory)

Where:

- Beginning & Ending Inventory include all three kinds of inventory: 1) Materials/supplies used to manufacture the finished good, 2) Work-in-progress (items that are in process but aren’t finished), and 3) Finished goods (completed products that are ready for sale).

- Purchases include all materials, supplies and other inputs purchased for the manufacturing of the product.

- Direct labour costs include wages and benefits of factory workers involved directly in manufacturing the product.

- Overhead includes rent, electricity and other expenses related specifically to the operation of the manufacturing area for the product.

Accounting Methods for Cost of Goods Sold: FIFO and LIFO

The value of COGS depends on the Inventory accounting method employed by a company. There are 2 main methods to account for inventory and by implication, Cost of Goods Sold.

1. First-in-first-out (FIFO)

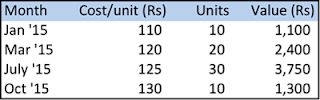

In the FIFO method, it is assumed that the inventory acquired first, is sold first. Let's explain with an example. Suppose firm ‘A’ manufactures pearl earrings. It buys pearls from a vendor (uses 1 pearl per earring), transforms them into earrings at its facility and then sells them at the local market. At the beginning of 2015, ‘A’ had a beginning inventory of 10 pearls, bought at Rs 100 each. A’s pearl purchases during 2015 were as follows:

- Purchase data for FIFO Inventory & COGS Calculation

- Calculation of FIFO Inventory & COGS

Now lets assume 60 earrings (30 pairs) are sold in 2015. Per FIFO accounting rules, the pearls acquired first, will be charged to sales first. This means that the 60 pearls used in the earrings sold in 2015 will include the 10 in beginning inventory, the 10 bought in Jan, the 20 bought in Mar, and 20 from the pearls bought in July.

- COGS: The total cost of pearls included in COGS will be = Rs. 10 x 100 + 10 x 110 + 20 x 120 + 20 x 125 = Rs. 7,000.

- Ending Inventory: The ending inventory of pearls will be = cost of pearls left = Rs. 10 x 125 + 10 x 130 = Rs. 2,550.

2. Last-in-first-out (LIFO)

In the LIFO method, it is assumed that the inventory acquired last, is sold first. Let's use the same example as above.

- Calculation of LIFO Inventory & COGS

- COGS: If 60 earrings are sold in 2015, the total cost of pearls included in COGS will be = Rs. 10 x 130 + 30 x 125 + 20 x 120 = Rs. 7,450.

- Ending Inventory: The ending inventory of pearls will be = cost of pearls left = Rs. 10 x 110 + 10 x 100 = Rs. 2,100.

LIFO vs. FIFO: Advantages and Disadvantages

The FIFO method is the more widely used method of Inventory accounting. The reasons are provided below.

LIFO

- Lower taxes, higher cash (Advantage): Prices usually rise over time, like we’ve assumed in our example above. In such an environment, the LIFO method charges the most-recent, higher-cost purchases and inventory to sales, giving a higher Cost of Goods Sold and lower Net profit. The advantage of using this method then (vs. FIFO accounting) is that companies pay lower tax (tax is calculated off the net profit value) and thus have higher cash balances.

- Outdated Inventory values (Disadvantage): Since the oldest products are left in inventory under LIFO, over time, Inventory values can get quite outdated (especially when prices or are technology is changing quickly). The LIFO method can also lead to Inventory Obsolescence.

- Potential for manipulation (Disadvantage). LIFO has been used by companies in the past to manipulate earnings and mislead investors. This happens when companies conduct a planned LIFO liquidation where they purchase less that they sell, so that can charge low-cost, old inventory to current sales and artificially inflate profits.

- Banned under IFRS (Disadvantage). While allowed under US GAAP, LIFO accounting is banned under IFRS (most of the world uses IFRS) because of the reasons mentioned above - 1) its use to lower profits to reduce tax liability, 2) outdated and obsolete inventory, 3) potential for earnings manipulation.

- Not feasible for perishable products (Disadvantage). LIFO is not advisable for perishable product businesses since the oldest products kept in inventory can expire before they're sold, leading to losses for the company.

FIFO

- Higher taxes, lower cash (Disadvantage): In an inflationary environment, since the FIFO method charges the oldest inventory and purchases to sales first, giving a lower Cost of Goods Sold and higher Net profit (vs. LIFO), companies using FIFO pay higher tax and have lower cash balances.

- Inventory values aligned with market (Advantage): Since the most recently manufactured products reside in inventory, inventory values reflect market reality more accurately than the LIFO method. The chances of inventory obsolescence are also much lower.

- Companies cannot manipulate earnings (Advantage). Under the FIFO method, companies cannot manipulate earnings by choosing which units to ship as opposed to LIFO, where LIFO liquidations can be used to inflate profits.

- Recommended for perishable products (Advantage). FIFO is recommended for perishable product businesses since the oldest products (at risk of expiry of shelf life) are shipped first.

- More widely used than LIFO (Advantage). Given all the advantages mentioned above, and the fact that LIFO is banned by the IFRS, the FIFO method is more widely used than LIFO.

Example of Detailed COGS Calculation for Manufacturing Company

Now that you have the requisite theoretical background, we're going to do a detailed, step-by-step calculation of the Cost of Goods Sold for a manufacturing business. We're going to use FIFO accounting for inventory.

Let’s assume that you own a firm A. You’ve tasked an Accountant with calculating the Cost of Goods Sold by you firm for 2015. Here’s the data you have, and what you present to the Accountant:

1. Data available to Accountant for estimating Cost of Goods Sold

As shown in the table above, the data available includes:

- Beginning Inventory for 2015 (Both units and cost/unit for the firm's 2014 Ending Inventory is available in the firm’s financial statements - this is Beginning Inventory for 2015).

- Purchase of materials (Both units and cost/unit are available. The firm uses 1 unit of material per unit of finished goods produced).

- Direct labour costs (Companies usually multiply the hours worked by manufacturing workers by their hourly wage rate to get direct labour costs).

- Manufacturing Overhead (This is not as straightforward to determine as the other components. Accountants will often assign a certain percentage of the total utility, rent and other overhead costs of a factory, to a specific final product).

- Ending Inventory for 2015 (Only units are available. The accountant will have to calculate cost/ unit. We will illustrate how to do this in this example).

2. Accountant first calculates Cost/unit (of Finished goods) Produced

In order do this, he first calculates the number of units of Finished goods (FG) produced in 2015.

- Number of units (of Finished goods) produced

He assumes (upon inspection) that the WIP units lying in both Beginning and Ending inventory are 70% complete - he treats these as 70% of a Finished good (FG), in his calculations.

Mathematically, he knows that:

No. of FG units produced during the year = No. of FG units sold during the year + No. of FG units in Ending Inventory - No. of FG units in Beginning Inventory

Using this identity, for firm A, he calculates:

No. of FG units in Beginning Inventory = 10 + 70% *15 = 20.5

No. of FG units in Ending Inventory = 5 + 70% *5 = 8.5

Plugging these values into the identity above, he gets:

No. of FG units produced in 2015 = 135 + 8.5 - 20.5= 123

- Cost/unit (of Finished Goods) produced

To estimate Cost/unit of finished goods produced during 2015, the Accountant calculates and sums up the cost of materials used/unit, direct labour used/unit and manufacturing overhead/unit of FG produced.

Since 1 unit of material is used per unit of FG, Cost of materials used per unit of FG = Rs 6/unit. (Given)

Cost of direct labour used per unit of FG produced = 400/123 = Rs 3.3

Cost of overhead per unit of FG produced = 300/123 = Rs 2.4

Consequently,

Cost per unit of FG produced in 2015 = 6 + 3.3 + 2.4 = Rs 11.7

3. Accountant applies FIFO accounting principles to Unit cost Calculations to derive COGS

- The Cost of Goods Sold is not = the cost of goods produced in 2015, because per the FIFO method, Finished goods in Beginning Inventory (BI) are sold first. Beginning Inventory for the firm includes 10 units of FG, 15 units of WIP and 30 units of materials, with Total cost of Beginning Inventory = Rs 355.

- The WIP units are 70% complete. The Accountant estimates that the Cost of processing WIP units into FG in 2015 = Rs. 11.7 x 30% x 15 = Rs 52.6.

- The cost of converting each unit of material in BI into FG = Cost of direct labour used per unit of FG + Cost of overhead per unit of FG = Rs 3.3 + 2.4 = Rs 5.7. Hence, Cost of converting all materials in BI into FG = Rs 5.7 x 30 = Rs 170.7.

- Consequently, the Accountant estimates that the 135 units of finished goods sold in 2015, included 55 units (10+15+30) from Beginning Inventory (FG as well as WIP and materials processed into FG), which cost Rs 355 to begin with, and a further 223.3 (52.6 + 170.7) to convert to finished goods. Hence, the Total cost of the 55 units of FG sold from BI = 355 + 223.3 = Rs 578.3.

- The remaining 80 units sold (135-55), cost Rs 11.7 per unit or Rs 935.3 (11.7 x 55) to produce.

- Hence, the Cost of Goods Sold in 2015 = 578.3 + 935.3 = Rs 1,513.6

4. Accountant applies FIFO accounting principles to Unit cost Calculations to derive cost of Ending Inventory

Given that per FIFO, Ending Inventory (EI) includes the most recently produced goods, the cost of EI is easy to calculate now.

EI for firm A includes 5 units of FG (cost = 5 x 11.7 = Rs. 58.5), 5 units of WIP (cost = 5 x 11.7 x 70% = Rs 40.9) and 18 units of materials (cost = 18 x 6 = Rs 108).

Hence, Total cost of Ending Inventory = 58.5 + 40.9 + 108 = Rs 207.4.

Hence, Total cost of Ending Inventory = 58.5 + 40.9 + 108 = Rs 207.4.

5. Accountant Verifies calculations against the Cost of Goods Sold Identity

COGS= Purchases + Direct labour costs + Overhead (manufacturing) - (Ending Inventory - Beginning Inventory)

The Accountant verifies his calculations against the COGS identity (reproduced above) to make sure that his calculations are mathematically correct.

RHS = 666 + 400 + 300 -206.4 + 355 = 1,513.6

LHS = 1,513.6

LHS = 1,513.6

Hence verified.

No comments:

Post a Comment